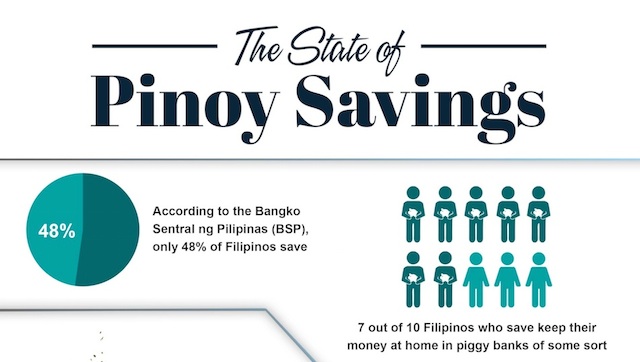

Did you know that only 48% of Filipinos practice the concept of “saving” money? And out of that percentage, 7 out 10 simply keeps their money at home and not in financial institutions such as banks!

These statistics from the Banko Sentral ng Pilipinas (BSP) is actually alarming given the idea that our money are generally much safer in banks compared to our homes which are susceptible to robbery / theft, fire, or the bad habit of impulsive spending!

These were discussed in the recent Cebuana Lhuillier press conference about Financial Inclusion and Micro Savings. held at New World Hotel in Makati City. Senator Francis ‘Chiz‘ Escudero was guest of honor and gave a brief speech about the State of Pinoy Savings in the Philippines as Chairman of the Financial Committee in the Senate.

So let us look into some of the more common reasons why Filipinos are hesitant on saving with banks:

Top 5 Reasons Why Filipinos Don’t Open Bank Accounts:

- High Initial Deposit

- It’s true that most banks in Metro Manila have a minimum deposit of Php 5,000 or Php 10,000 as initial deposit to open a bank account!

- The GOOD NEWS is, the BSP has now released a new directive relaxing this requirement on initial deposit! In fact, we recently learned that Cebuana Lhuillier‘s Microsavings only requires as low as Php 50 initial deposit! (more on this in the feature below this article).

- High Maintaining Balance

- Yes, aside from the initial deposit, some banks also requires depositors to have an average maintianing balance in a month, otherwise, maintenance charges are charged to the depositor.

- This is quite hard to do for ordinary Filipino families who needs to use their money in times of need, and hence cannot mainitain a certain “balance” religiously.

- Dormancy Charges

- For forgetful people like me, I usually fall in this trap of Dormancy charges. For others, they just basically has no extra money to put in the account for a long time.

- Numerous Requirements

- With the lack of a National ID in the Philippines, having a proper government identification card is still a problem for most citizens. And asking for quite a number of them as bank requirements can really hinder our countrymen.

- The GOOD NEWS is, with the Cebuana Lhuillier Microsavings, you only need 1 Valid ID to open a bank account! (more on this in the feature below this article)

- Distance of Business from Home

- Although there are a lot of banks in Metro Manila, this is not the case for the rural and coastal areas of the Philippines.

- In fact, only 33% of the Philippine land area is covered by banking institutions. That is only about 551 municipalities and cities in the whole country!

“Unbanked No More” with Cebuana Lhuillier Microsavings

Cebuana Lhuillier, one of the country’s leading microfinancial services company, recently unveiled the Cebuana Lhuillier Micro Savings, which will provide Filipinos with a more convenient and affordable means to save their hard-earned money.

Acting as a cash agent of the Cebuana Lhuillier Rural Bank (CLRB), micro savings is Cebuana Lhuillier’s platform for Filipinos to overcome the barriers to saving. Cebuana Lhuillier Micro Savings enables every Filipino to break through these barriers.

Opening a Cebuana Lhuillier MicroSavings account requires only one valid ID and a minimal Php 50 initial deposit. And because of Cebuana Lhuillier’s wide network of branches comprised of 2,500 retail infrastructures, account holders can deposit and withdraw anywhere at their most convenient hours.

The product is in line with the Cebuana Lhuillier’s mission of financial inclusion, which has been the thrust of the company for the past 30 years.

eCebuana Mobile App

To ensure that micro savings account holders can fully maximize the use of their savings account and ensure greater connectivity, Cebuana Lhuillier will also be launching its very own eCebuana app which allows micro savings users to check their balance and send money through remittance, as well as load prepaid credits to their phones, and pay their bills by integrating it to their Cebuana Lhuillier Micro Savings account.

The app is just the first step in a long line of innovations connected to the micro savings product – on top of which is its migration to an EMV-enabled card which can be accessed through ATMs (automated teller machines). It will also carry a debit and credit facility for online and cashless shopping, provide access to auxiliary services and help corporate and MSME (micro, small, and medium enterprises) clients manage their business through payroll cash management solutions and more including remit-to-and-from savings account; pay and deposit from savings account; and an international remit-to-account features!

“With BSP’s basic deposit framework, Cebuana Lhuillier Micro Savings completes the full roster of our services, all designed and developed with financial inclusion in mind. We’ve come full circle—from offering collateralized loans or pawning, remittance service, micro insurance and now, micro savings—all of these products were designed with Filipinos from all walks of life in mind especially the unbanked and underserved, who would not have access to these financial services given their circumstances in life,” said Jean Henri Lhuillier, President & CEO of Cebuana Lhuillier.

Moreover, the launch of Cebuana Lhuillier Micro Savings coincides with the launch of the #KayaNa: Unbanked Filipinos No More Movement, which aims to transform the landscape of saving in the Philippines. In light and in support of the BSP’s call for greater financial inclusion among Filipinos, Cebuana Lhuillier aims to reach more underserved Filipinos and empower them to save for the future through its micro savings product.

“Cebuana Lhuillier is also adapting a new philosophy, which is financial wellness. Our goal is not just to provide quick cash to the underbanked and unbanked for their short-term financial needs but to become an enabler for a better future for them. Allowing more and more Filipinos to steer their own direction and be captains of their own ship. We want to help them graduate from being dependent through bridge financing options for them to experience financial freedom,” Lhuillier adds.

0 Comments